Part 11: Size Matters (Vineyard and Winery sizes matter, that is.)

The year was 1986. The focus was now on financial projections and the determination of how much more additional cash would be needed. How soon could the project reach stability and generate profits. One of Rob’s friends, an astute attorney, whom I met on one of my weekly trips to NYC, giggled and told me the old adage in the US. “To make a small fortune with a winery, start with a large fortune.” It was distressing and also thought provoking.

The draft vision looked almost enticing as a quick sketch. It was to change a lot.

From the mass of documentation we had identified two charts, one on production cost per case at different volume levels and one that revealed the level of production needed to achieve return on investment. It was clear that we had to focus on a target of rapidly growing to 40-60,000 cases. The wisdom in those charts was that virtually all wineries producing less than 25,000 cases were losing money. Yes, in the boutique winery business, size does matter.

The wishful thinking idea that these old buildings could become the basis for the winery.

Defining commercial wineries, such as Gallo which has been the dominant giant of the industry for years, begins at one hundred thousand cases and extends to millions of cases.

Our plans were now being completely redefined, as they should, not by a narrowly focused view based on what might be appealing to a family but by the financial realities clearly identified by those two charts.

We expanded our viticultural concept to target on 35 acres of various varietals. Chardonnay was going to be just one of the several varietals to be selected. One more time, we went back to the drawing board.

The initial thought of converting the old barns and turning them into the first stage of a winery was abandoned during discussions of cooperage size requirements for stainless steel and the barrel cellar capacity, both to be temperature controlled. All factors that were never in focus in Burgundy.

The list of things to do was getting longer.

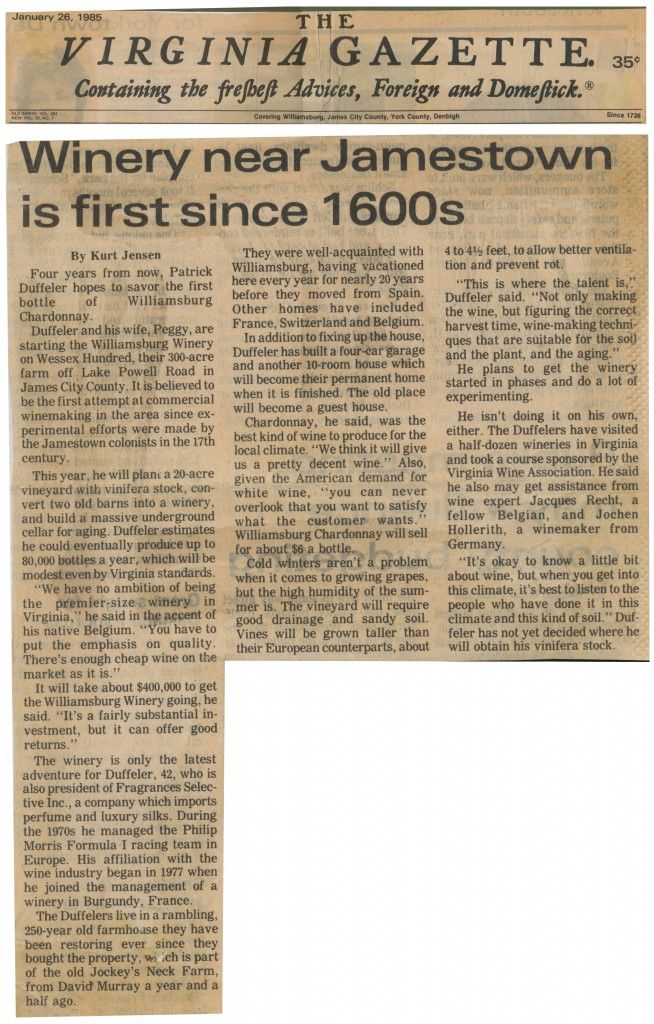

We were encouraged by the coverage we had received in the local press and by some local enthusiasts, though there were still a number of people who looked at us with a quizzical look. Reading their minds, I thought I was hearing “A winery in Williamsburg? Is this for real?”

While I was in NY, I had made arrangements to visit the budding wineries on Long Island. I was introduced to Jeanette Smith, a very nice young lady from Virginia, who was working as agricultural extension specialist for the area and was very knowledgeable in viticulture.

We met at my office in Long Island, and I made a proposal for her to join our project and she accepted.

Back in Williamsburg, Peggy and I met with Rodgers Huff, a senior executive at United Virginia Bank who was very familiar with our acquired property as he had his own hunt club and the farm had been his favorite hunting grounds for many years. We were delighted that he had offered to renew the lease agreement in that his vigilance kept poachers away from the farm where Peggy was living with the young British au-pair gal and our two sons. I was still on my weekly commute.

Rodgers was one of those exceptional clear-headed, old-fashioned bankers, who would tell you in a low-key, friendly tone. “This is bankable and that is not.”

The next meeting was an introduction organized by Rodgers with Bud Geddy who, at that time, had a connection with the law office of our lawyer friends, John Patterson and John Cogbill. Mr. Geddy had been the Mayor of Williamsburg and intimately knew the inner workings of the County Government apparatus. He introduced a bill that provided the specific permit for the establishment of the winery on the farm.

Returning to New York, and polishing the new sets of financial projections, it was clear that boosting the equity was going to be required. With Rob’s assistance, we developed the first document on the planning of the project and circulated it to a few contacts. We then brought together a small group of those interested in the wine industry and formed a limited partnership with the help of the law firm.

While the business of Fragrances Selective had been growing nicely, more than doubling itself in the US, I was informed that the family controlling the operation had made a strategic decision. They would focus on their own home market and forego some of the international expansion for which I had been engaged and had actively pursued over the prior 5 years. That change of focus raised a new question. I am not one to just accept coasting as either a business approach or a lifestyle direction. A conversation was initiated that resulted in an agreement that by early ’87, I would be free to dedicate one hundred percent of my time to the winery project.

Times of great excitement, anticipation and anxiety.

(To be continued)

Patrick G. Duffeler

Founder & CEO